x402 and The Future of Agentic Payments

In 1983, ARPANET switched to TCP/IP, turning the internet from an experiment into a network.

Now, in 2025, another protocol shift is underway. The long dormant HTTP 402 status code, Payment Required, is finally becoming usable.

For decades, the web has lacked a native payment layer. The 402 code was reserved for it but never implemented. With the rise of stablecoins and blockchain based settlement, that missing layer is finally here.

The forgotten status code

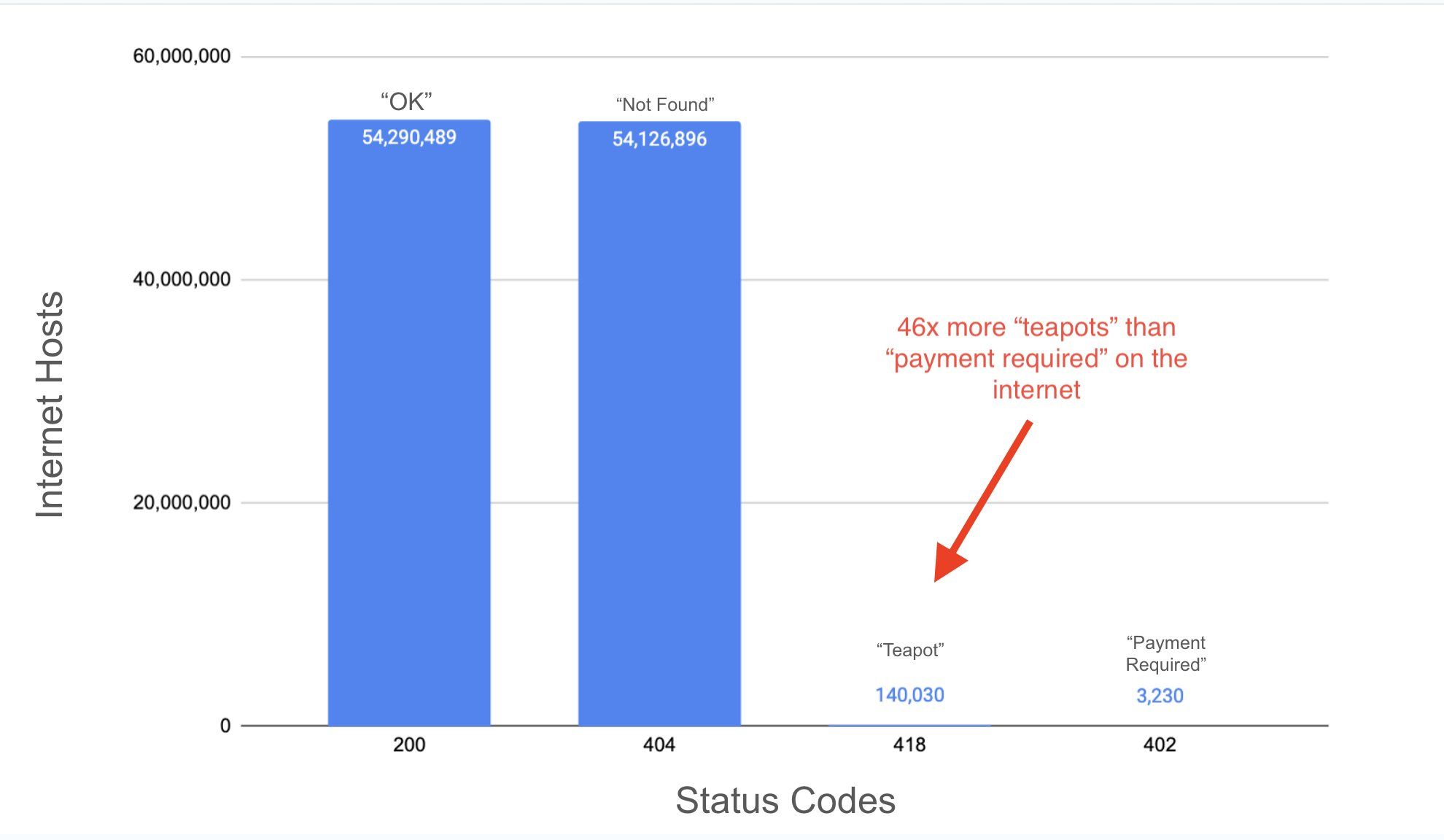

HTTP, the protocol that underpins the web, uses status codes to convey responses. A few familiar examples include:

- 200 – OK

- 404 – Not Found

- 418 – I’m a Teapot (yes, really)

- 402 – Payment Required

While some of these codes are widely used (200 and 404), others have become more of a curiosity. In fact, a quick Censys search shows just how rare 402 really is. There are 46 times more servers returning “I’m a Teapot” than those implementing “Payment Required.”

Created in the 1990s, 402 was left virtually untouched for almost 30 years.

Coinbase and Cloudflare revive 402

Recently, Coinbase revived 402, building a blockchain first payment standard to enable internet native payments. Maybe this is what the creators of HTTP had in mind all along, and there is something magical seeing a standard created 30 years ago finding relevance today.

But standards alone do not create adoption. 402 still lacked a killer use case. That is, until Cloudflare introduced “pay per crawl.”

Think about billions of agents crawling the internet in search of data. These agents could never make micropayments to websites in an internet native way. Now, with x402, they can.

Why crypto is essential

Why does crypto matter here? Because you can’t do sub-$1 payments with credit cards.

The reason is simple: flat transaction fees.

- Interchange fee: ~1.3%–3.5% of the transaction amount

- Flat fee: $0.10–$0.30 per swipe

That means a $1 transaction can carry a fee of over 30%. Micropayments break under that model.

Blockchains, however, provide a real-time payment system that can send and receive fractions of a cent anywhere in the world, in seconds. This makes micropayments and agentic payments finally viable.

The Risks of Agentic Payments

The possibilities for x402 are massive. But enabling agents to transact arbitrarily online also introduces risks.

To understand these risks, consider the credit card system. There are two broad categories of fraud:

- Consumer fraud against the merchant – stolen cards, chargebacks, buyer’s remorse.

- Merchant fraud against the consumer – consumers pay, but the merchant fails to deliver.

Credit cards protect consumers in case of merchant fraud. Meanwhile, companies like Riskified and Forter protect merchants from consumer fraud.

With crypto, the equation shifts. Payments settle instantly, ensuring merchants are protected from consumer fraud. But consumers are exposed. A bad merchant can instantly withdraw funds, create new wallets, and disappear without consequence.

The challenge for 402

Now, imagine billions of agents transacting at light speed with millions of “merchants” represented only by domains and wallet addresses. There’s no physical presence, no brand recognition, no built-in trust.

For x402 to succeed, agents will need a way to verify that the transactions they attempt are legitimate and that they will actually receive what they are paying for.

Blockaid’s role

This is where Blockaid comes in. We are uniquely positioned to address this challenge.

Blockaid is already embedded across most leading self-custodial wallets, scanning hundreds of millions of transactions and protecting users from signing malicious ones.

Users today are protected. Tomorrow, agents will need the same level of security.

Conclusion

The x402 standard transforms a 30-year-old placeholder into a living part of the internet. With the rise of stablecoins and blockchain payments, it can finally fulfill its purpose: enabling internet native payments at scale.

But for this future to work, trust must be built into the system. Without it, agentic payments cannot scale safely.

At Blockaid, we’re already solving these problems, and we’re excited to help shape the next era of secure, internet native payments.

Blockaid is securing the biggest companies operating onchain

Get in touch to learn how Blockaid helps teams secure their infrastructure, operations, and users.