How Blockaid Helps Exchanges Turn Token Listings into a Competitive Advantage

As an exchange, you want to list tokens fast. Every new listing brings in trading volume, attracts users, and strengthens your position in the market.

If you’re like most exchanges, you rely on a multi-step manual listing process to assess compliance, security, and market demand. Every token goes through extensive due diligence, regulatory checks, and technical audits before approval.

You do this because listing the wrong token can be catastrophic. A bad listing can mean fraud, regulatory scrutiny, and reputational damage.

But this process isn’t just slow—it’s costing you:

- Lost trading volume. Delays push traders to faster competitors, draining liquidity from the platform.

- Weakened market position. Being late to list high-demand tokens means missing out on key growth opportunities.

- Operational bottlenecks. Listing teams are overwhelmed, slowing down expansion and diverting resources from strategic initiatives.

For years, the industry has treated slow, manual token reviews as the cost of security.

But what if security didn’t have to be a bottleneck? What if legitimate tokens could be listed instantly, while scams were blocked automatically—without adding risk?

That’s where Blockaid comes in.

Blockaid enables instant token listing—without compromising security

The challenge with moving from a manual approval process to a dynamic approach has always been control.

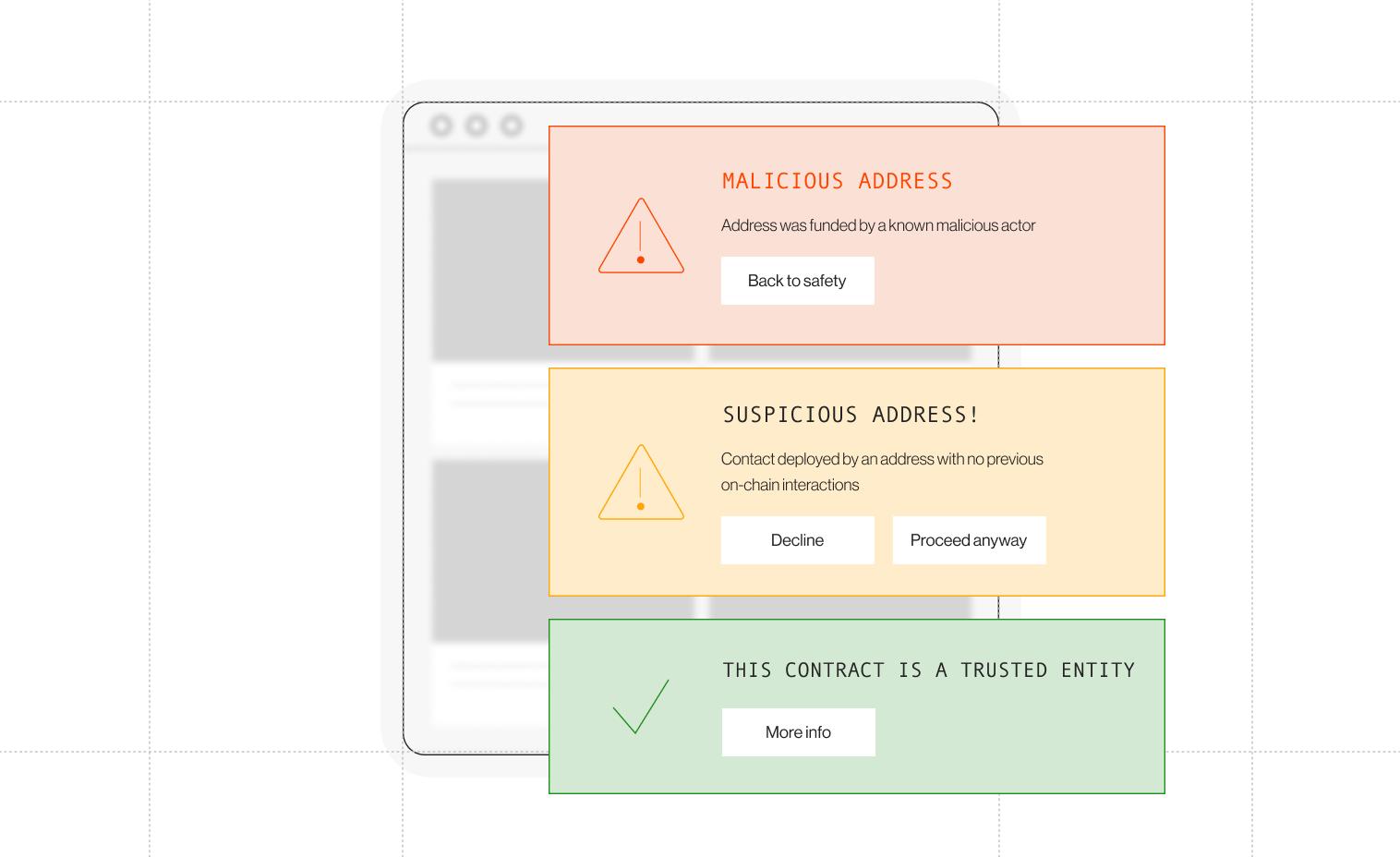

Without a reliable way to distinguish between safe and malicious tokens in real time, exchanges have assumed they need to block everything until proven otherwise.

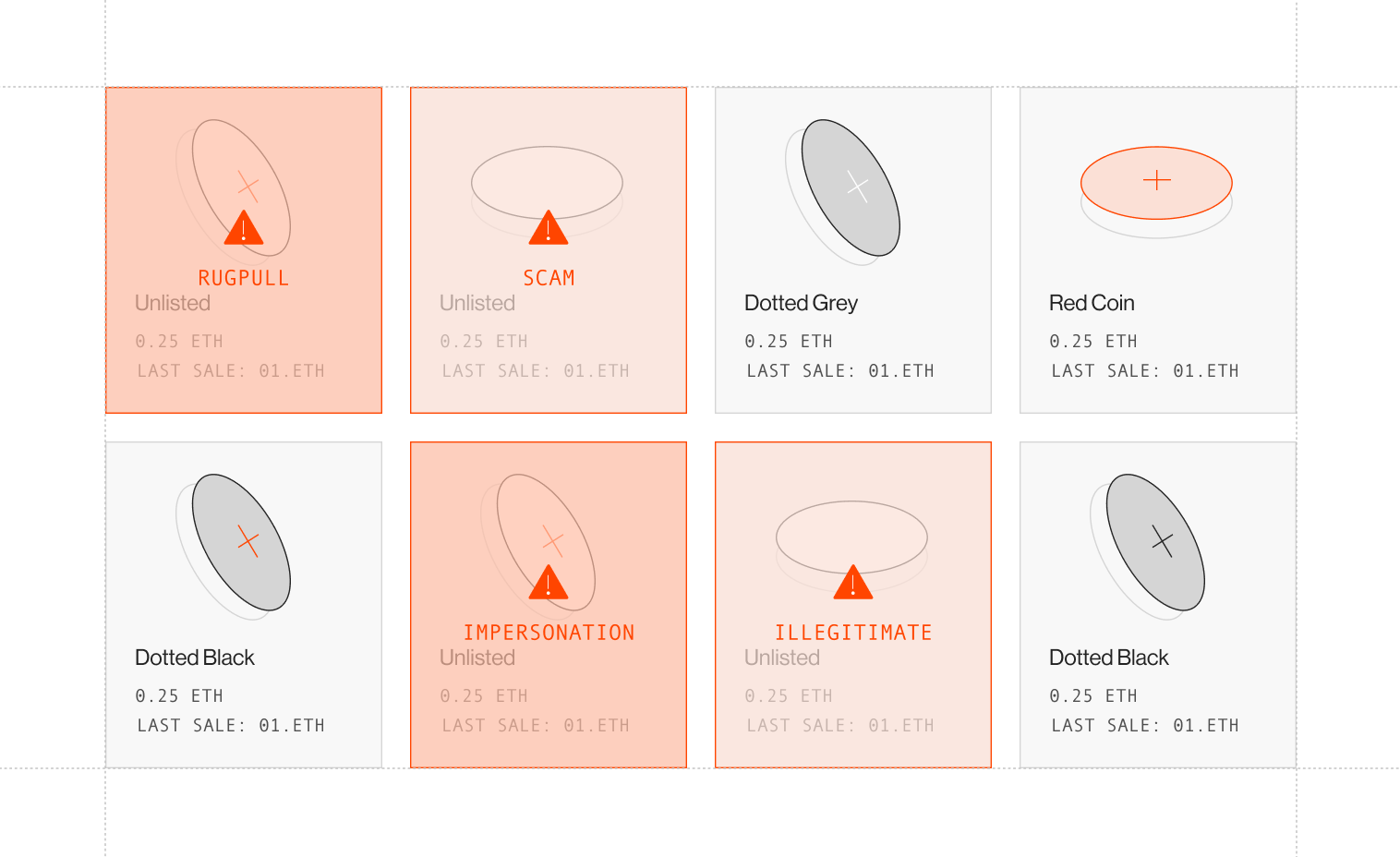

Blockaid removes that friction with a dynamic filtering system that enables platforms to automatically list safe, legitimate tokens and filter out dangerous ones.

This isn’t just a theoretical solution—it’s already trusted by industry leaders. Platforms like Uniswap, CoinTracker, and DEX Screener rely on Blockaid to provide real-time security guidance, protecting millions of users from scam tokens, liquidity traps, and hidden exploits.

The same system that powers these high-volume, high-trust platforms can now be used by exchanges to move faster—without sacrificing security.

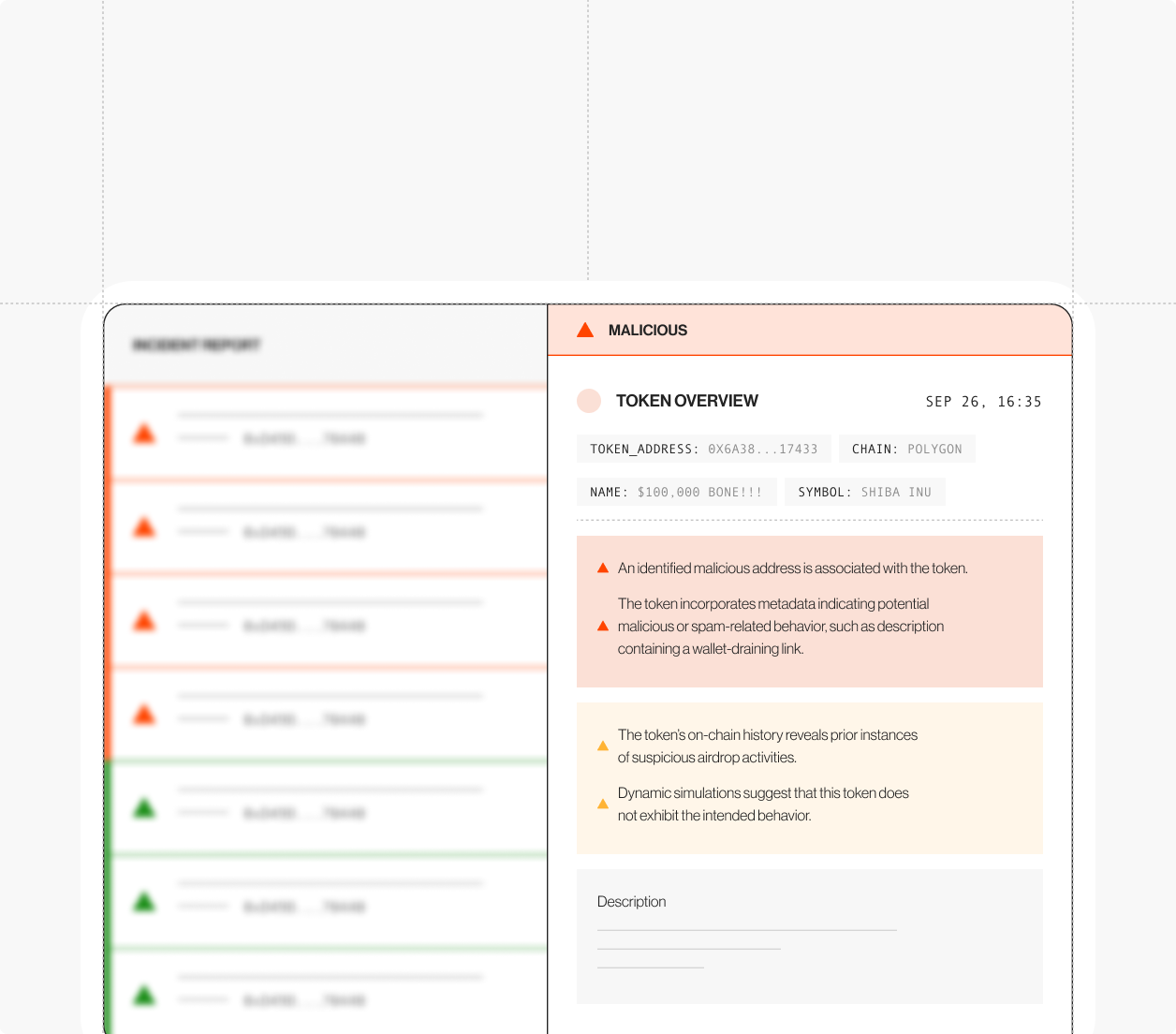

Instead of relying on static rules or manual checks, Blockaid continuously evaluates:

- Bytecode and contract structure to detect malicious patterns, hidden attack vectors, and suspicious upgrade mechanisms.

- Wallet and funding sources to assess the legitimacy of token creators, fund flows, and network relationships.

- Liquidity behavior to identify liquidity manipulation, wash trading, and rug pull tactics before they impact users.

This real-time security layer allows exchanges to confidently shift from a manual review process to an automated filtering model, ensuring:

- Legitimate projects aren’t delayed and safe tokens move forward immediately, increasing trading volume and user engagement.

- Regulatory risk is mitigated by detecting sanctioned addresses (OFAC and others), illicit fund movements, and high-risk wallets, helping exchanges meet their compliance requirements—without slowing down legitimate tokens.

- Scam tokens never gain traction and malicious assets are flagged before users interact with them, reducing fraud risk.

Blockaid doesn’t just catch scams—it creates the framework for secure, automated token support, ensuring both speed and compliance without added risk.

The only token scanning engine backed by real-world data

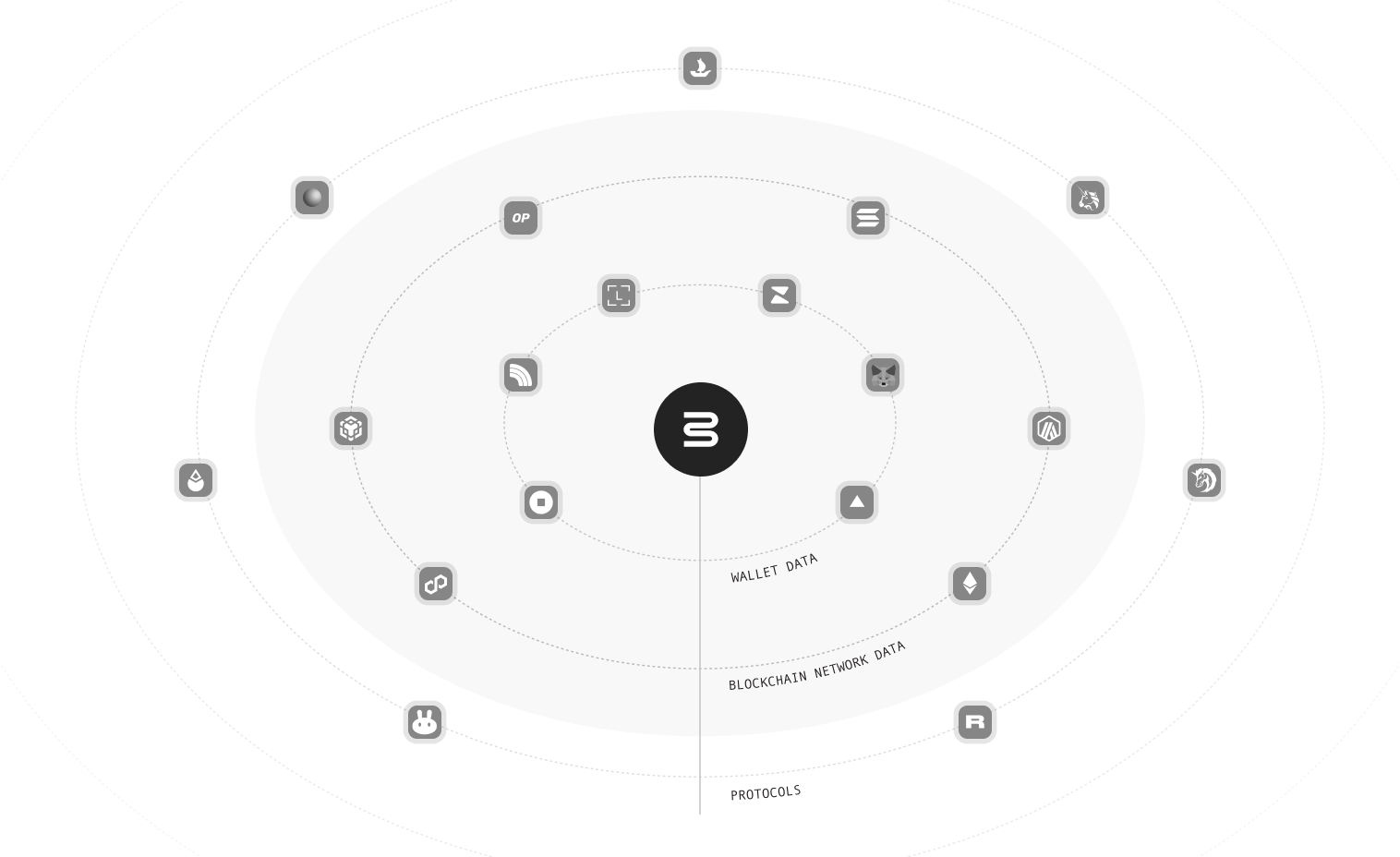

Blockaid isn’t just analyzing contract code—it has unmatched visibility into how tokens behave in the real world.

That’s because Blockaid is integrated into the top wallets used by millions of traders every day, including MetaMask, Coinbase Wallet, Backpack, Zerion, Rainbow, and others. This gives exchanges a unique source of intelligence that no other security provider can match.

We see which tokens real users are trading, swapping, and holding. Most security solutions only analyze contract data, but Blockaid tracks which tokens are actually being used in legitimate transactions.

We distinguish real demand from artificial volume. Wash trading, bot-driven pumps, and fake liquidity pools can make a scam token look real—but Blockaid’s access to real user interactions allows us to filter out manipulation.

We detect malicious activity before it spreads. If a token is linked to a wallet drainer, phishing site, or scam airdrop, Blockaid flags it before users are affected.

No other security solution has this data.

By combining onchain intelligence with real-world usage data, Blockaid gives exchanges the power to make faster, safer, and smarter decisions.

Retain control while listing tokens faster with Blockaid’s customizable policies

Every exchange has different security requirements, risk tolerances, and regulatory obligations. A one-size-fits-all approach to token security doesn’t work. That’s why the Blockaid platform is fully customizable—giving exchanges complete control over how tokens are filtered, classified, and managed.

Exchanges can define:

- Custom risk thresholds and set policies based on contract complexity, liquidity depth, or past transaction behavior.

- Automated security rules for exactly which tokens should be allowed, flagged for further review, or blocked outright.

- Regulatory compliance filters to proactively prevent listing of tokens linked to sanctioned addresses, illicit funds, or high-risk activities—without slowing down legitimate assets.

By embedding real-time monitoring and automated enforcement directly into the token pipeline, Blockaid ensures that security happens at the speed of the market—without requiring constant manual intervention.

This means:

- Security teams set the rules—Blockaid enforces them. Exchanges stay in control while eliminating bottlenecks.

- Token support scales without increasing risk. More assets move through safely, expanding trading opportunities.

- Compliance remains airtight. Blockaid ODR ensures that regulatory safeguards are continuously applied in real time.

With the Blockaid platform, you can move beyond reactive security with a fully automated, risk-controlled environment where legitimate tokens move freely, and bad actors never gain traction.

Turn token listings into a competitive advantage

For exchanges, token security has always been a balancing act—move too slowly, and you lose trading volume; move too fast, and you take on unacceptable risk. The Blockaid platform removes that tradeoff entirely.

By shifting from a manual approval process to a dynamic filtering model, you can gain a strategic advantage instead of a bottleneck:

- Faster listing: Legitimate assets move through instantly, keeping pace with market demand.

- Stronger security: The Blockaid platform prevents malicious tokens from ever reaching users, stopping scams before they spread.

- Operational efficiency: Blockaid ODR automates 90% of manual review work, allowing teams to focus on high-value priorities.

The result? More volume, more users, more trust—without increasing risk.

Blockaid is already protecting millions of transactions across major wallets and platforms. It’s time for exchanges to do the same.

👉 Your token listing process shouldn’t be a bottleneck.

Get in touch now for a quick consultation on your current token listing policy and see how Blockaid can help you move faster, eliminate manual delays, and block threats before they reach your exchange.

Blockaid is securing the biggest companies operating onchain

Get in touch to learn how Blockaid helps teams secure their infrastructure, operations, and users.